After two decades of civil war, Somalia has regained some peace and stability, however economic institutions are weak and the country remains vulnerable to political, economic and environmental shocks. With a GDP per capita of $435 (2016) Somalia is significantly lower than the SSA average of $1,570. In addition, 73 % live in poverty, 80% lives in rural areas, and 43% live on $1/day.

Somalis are considered a highly entrepreneurial people but recent market studies show that less than 5% of the market demand for micro and small enterprise finance is currently being met in Somalia, representing over 2 million potential enterprises and hundreds of millions of dollars.

Kaah Express, a leading international Money Service Business (MSB) serving the global Somali diaspora with operations in 17 sending countries worldwide and more than 80 branches and agents in Somalia, has recognised that financial inclusion in Somalia represents both a business opportunity and enabler for economic development, peace and security.

To meet this huge unmet demand, Kaah Express established Kaah International Microfinance Services (KIMS) in 2014, as the first dedicated, privately owned microfinance institution in Somalia, providing commercially viable and responsible financial services to low income but economically active populations.

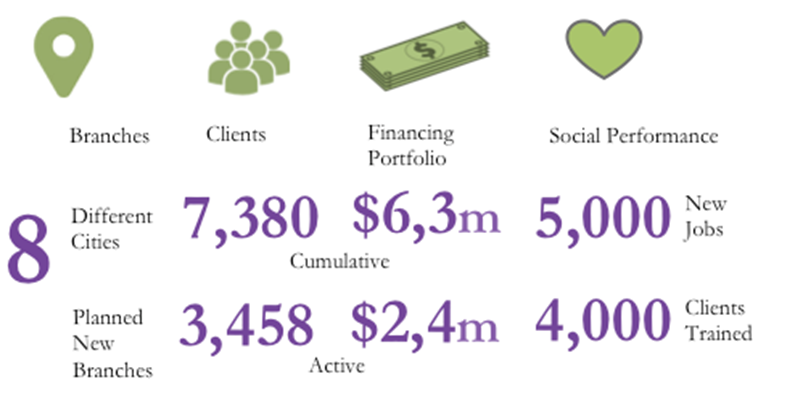

KIMS has significantly improved financial access for vulnerable populations, particularly youth and women. KIMS only provides financing for economically productive activities, therefore having a direct impact on local economic development and sustainable job creation in line with SDG8. As of June 2017, KIMS has delivered the following impact:

KIMS has developed an effective public-private partnership delivery model including partnerships with international institutions to support refugee returnees, as well as to mitigate the impact of the current drought through enabling alternative livelihoods for farmers, and supporting youth who are at high risk of economic out-migration.

KIMS also has an active dialogue with key Somali government agencies in order lobby for the introduction of enabling regulatory environment.

KIMS seeks to adhere to international best practices in microfinance enabling it to demonstrate readiness for the required investment that would enable it to grow to meet unmet market demand. KIMS is currently working with several international institutions to use risk-mitigation instruments such as guarantees to bring international investors into Somalia.

KIMS SUCCESS STORIES

Making a Successful Return

Ikran, Small Business Owner, Kismayo

Born in Kismayo, Ikram was forced by war to flee her home and resettle in Dadaab refugee camp in Kenya. After seven years Ikran was able to return to Kismayo.

As work was scarce, she was forced to look for unsuitable jobs and dangerous jobs. After receiving a $800 financing from KIMS, Ikran bought sheets of tin to built a shop, shelves to stock dates, cosmetics, soups, and pasta, and a freezer in order to sell ice cream.

Ikran states: “I now have a reliable income”.

Her shop provides her with enough money to pay for her children’s food and schooling.

Ikran makes regular repayments on her financing facility, and is now looking to qualify for a second, larger financing, which will enable her to increase her stock and serve even more customers.

Ikran, is one of more than 850 refugee returnees that KIMS has supported into sustainable livelihoods in Somalia.

Delivering hope, one cup at a time

Abdi Duale, Tea Shop Owner, Hargeisa

Born in Kismayo, Ikram was forced by war to flee her home and resettle in Dadaab refugee camp in Kenya. After seven years Ikran was able to return to Kismayo.

As work was scarce, she was forced to look for unsuitable jobs and dangerous jobs. After receiving a $800 financing from KIMS, Ikran bought sheets of tin to built a shop, shelves to stock dates, cosmetics, soups, and pasta, and a freezer in order to sell ice cream.

Ikran states: “I now have a reliable income”.

Her shop provides her with enough money to pay for her children’s food and schooling.

Ikran makes regular repayments on her financing facility, and is now looking to qualify for a second, larger financing, which will enable her to increase her stock and serve even more customers.

Ikran, is one of more than 850 refugee returnees that KIMS has supported into sustainable livelihoods in Somalia.

Delivering hope, one cup at a time

Abdi Duale, Tea Shop Owner, Hargeisa

Born in Kismayo, Ikram was forced by war to flee her home and resettle in Dadaab refugee camp in Kenya. After seven years Ikran was able to return to Kismayo.

As work was scarce, she was forced to look for unsuitable jobs and dangerous jobs. After receiving a $800 financing from KIMS, Ikran bought sheets of tin to built a shop, shelves to stock dates, cosmetics, soups, and pasta, and a freezer in order to sell ice cream.

Ikran states: “I now have a reliable income”.

Her shop provides her with enough money to pay for her children’s food and schooling.

Ikran makes regular repayments on her financing facility, and is now looking to qualify for a second, larger financing, which will enable her to increase her stock and serve even more customers.

Ikran, is one of more than 850 refugee returnees that KIMS has supported into sustainable livelihoods in Somalia.

Delivering hope, one cup at a time

Abdi Duale, Tea Shop Owner, Hargeisa